This is the Fed’s latest lesson on the job: incentive structures work.

There’s a famous line, attributed to Steve Jobs:

“Incentive structures work, so you have to be very careful about what you incent people to do because various incentive structures create all sorts of consequences which you can’t anticipate.”

This note is about the role of compensation & incentives. Specifically, those structured by the Federal Reserve & how they seem to be veering far from the mark. Markets realize when policymakers are being pushed to choose the carrot over stick approach. And the Fed’s being forced to offer a very expensive carrot indeed.

INCENTIVE CASE STUDY I: What Price Is Right?

Consider what JPM’s Govt-Only money market fund did during the run-up to the September bloodbath.

A fund with nearly a quarter trillion dollars, typically invested in repo and/or other cash-like assets with less than 30-days maturity, suddenly increased its weighted average maturity by almost 2x. During that same period, reported assets fell by around 10%.

There’s usually a “price” (not that you’ll like it..)

There’s one way that happens: pulling money out of the shortest-dated investments, which includes overnight repo. Now, we know that money went back into the market – but only after things got REALLY stressed. And we know exactly who was footing the bill & what levels it took in order to get JPM “incentivized” to participate once more.

For example, for this fund on a weighted average basis it works out to a little over $56bn in overnight financing provided (10/1 maturity) of US Government Treasury & Agency Collateral at 45bps over the Fed Effective Rate over September month end (Weighted Average Yield on 1-day financing by OGVXX over the turn = 2.35, EFFR = 1.90 on 9/30). It wasn’t just your generic mom & pop regional bank either.

Counterparties who willingly paid 45 over? BofA, Citi, Deutsche Bank, BNP, RBC, Nomura, TD, SocGen.. the list goes on.

Remember, that’s just over the September month end turn (9/30 to 10/1). That’s doesn’t include the periods of real stress (9/16 to 9/18). The compensation required for markets to function on those days was significantly higher.

What Would Jamie Do?

When pressed about JPM’s role in the mid-September move, Dimon was characteristically blunt. His offer in response to the Fed’s request for help in the transmission of easier funding?

Seriously.

Think about what this truly incredible line from the JPM conference call implies, deadpanned in response to questions regarding the bank’s response to the funding chaos unleashed mid-September:

Bottom line: The level at which banks indifference point comes into play is vastly different by institution. The largest of these providers of the marginal $, however, has little inclination to acquiesce: SFTs are a powerful lever. The incentive levels are several hundred basis points higher on an overnight basis (for some, perhaps not at all for others).

It may seem as though the “plumbing” issues have, by & large, been addressed. But that’s only because it hasn’t truly been tested yet. We’ll get a flavor at October month-end (Canadian bank year-end), and then the first real stress test during the long Thanksgiving Holiday turn that precedes November month end. The market grows complacent at its peril ahead of these events.

INCENTIVE CASE STUDY II: Buy What the Fed’s Buying, QE(D)

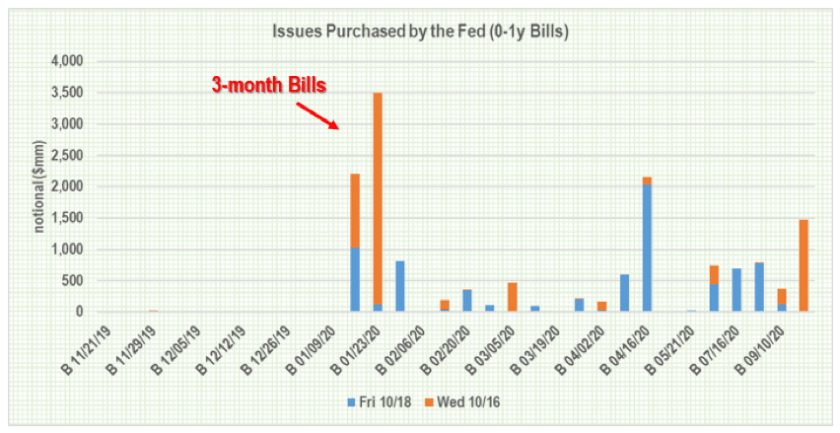

Here’s another example. The Fed has carried out 2 bills buying programs since the advent of “not QE”. Check out what they’ve bought thus far.

Notice that the vast majority of “not QE” has been done right in 3-month point of the curve. That’s noteworthy because a) it happens to also be the “rich” part of the UST curve since the dealer community rapidly richened that point up when they learned the Fed was planning to buy bills, and b) it means these purchases will all be rolling off in January (at which point they’ll be reinvested as add-on’s in the Treasury’s regularly scheduled bills auctions).

Now, today saw two regularly scheduled Treasury auctions: 3-month bills & 6-month bills. You might be wondering how many of those 3-month bills the investor community took down, knowing that’s exactly what the Fed’s trying to buy as well?

Buy, Buy, Buy…

The most in over a year & 2nd highest in the past decade.

That’s important because, as a technical aside, the Fed has been hoping their bills buying program will cause MMFs to park reinvestments in repo – not back in the bills market. Today seemed to suggest the opposite.

Indeed, at 65% of the auction, that’s the 3rd highest takedown as a % of total bills sold in the last decade.

Incentive structures work: investment funds scrambled to buy the same asset that the Fed’s been aggressively buying for the past week, at the expense of other issues the Fed hasn’t been. That’s hardly surprising. They’re trying to make money the way everyone else is. But in the context of what the Fed is trying to achieve by these operations, it just highlights the challenge of trying to corral a market into doing what you want.

The Fed’s carrying out “Not QE” as a way to manage truly astronomical moves in overnight funding markets in the only way they know how. The market’s taking that as a pretty good opportunity for a 24-hour trade.

INCENTIVE CASE STUDY III: A Lack of Control

Here’s another example: last week’s move in funding rates. Tuesday’s move in repo was generally expected as a combination of UST settlements plus the off-quarter mid-month tax date all helped push rates higher. SOFR hit 2.00 for the first time this month & EFFR-IOER went to +10bps, which is 2nd only to the +20bps move we saw September 17th. Wednesday’s move was less well telegraphed. GCF came lower on the day, but SOFR actually printed higher & EFFR remained stuck at 1.90 with the upper percentiles moving higher.

Yet again, this highlights the degree to which the Fed’s understanding of the problem appears out of sync with reality: buying bills does nothing really to address the issue of the transmission mechanism. Once more, the Fed thinks the problem is just with the level of bank reserves, which they’re addressing by removing collateral from the system in exchange for new reserves.

That’s not it.

In the first place, the issue appears to be with transmission mechanism – which has indeed been created by a state of collateral shortage which is systemic to the banking system. This isn’t solved by removing more collateral from the system; it’s solved by addressing the root problem.

…which is?

That root problem is relying on the 24 PDs whose hands have been tied by capital constraints post crisis. That’s not going away anytime soon. Do we really think policymakers are going to admit, after all this & just as the economic picture appears to be a little less rosy than it was a year or two ago, that what they’d planned post crisis is actually just causing another major problem in transmission of efficacious policy? One need not be a cynic to think “of course not”.

Be careful of what you “incent.”

Nothing short of a vast overhaul of capital measures is going to address this problem fully. We’ll see various roll-outs of policy measures between now & the end of this year, but (as mentioned previously) – probably midway thru the month of November – concerns around the reality of the year-end turn (and the Thanksgiving holiday week, for that matter) are going to come bubbling back to the surface.

INCENTIVE CASE STUDY IV: Who’s Leading Whom?

A final example. One of my favorite speeches by Bernanke includes his famous “hall of mirrors” quote. It goes like this:

If the Fed allows itself to be continually led by markets, this strategy quickly nullifies the benefits of “easing”. If “communication” is indeed to be intended as a form of monetary policy, then merely reacting to what the market tells you to do isn’t much help.

On that note, we look set to witness the 3rd interest rate “cut” this year.

We’re currently at a level from which the Fed has never NOT delivered what the market was expecting (in terms of a hike, cut, or on hold) in the last decade.

Thus, the fact that the Vice Chair last wk made no effort to walk back expectations just days prior to the blackout going into effect would suggest that they’re comfortable with current pricing. See attached, avg ex-ante probability priced for “hikes” “cuts” & “holds”.

Now, there’s been a lot of discussion about how the December FOMC might not see a similar “cut” because of the fact that “Not QE” has been rolled out which, to everyone but the Fed, appears to pretty clearly be yet another form of policy easing.

There’s a little less than 50% priced in for a December “cut” at this point – but if you think that’s a slam dunk for the Fed to pause…

Well, consider this:

Note, there’s been 50% or less of a “cut” priced into the subsequent meeting at the end of the day on each Fed “cut” we’ve gotten thus far. Within 3-4 days’ time, that’s all changed.

Be careful what you “incent.” Because if the market thinks the only thing which is keeping it elevated is the prospect of more “cuts” down the road, then it’s going to fit to that model appropriately.

Disclosure/Disclaimers:

This material may contain indicative terms & there is no representation that any transaction could have been executed at such terms. Proposed terms are for discussion purposes only.

OTC Derivatives Risk Disclosures:

Understand clearly the terms of any OTC derivative transaction you may enter into. You should carefully review these terms with your counterparty.

Also, understand the nature of your exposure. Consequently, you should be satisfied that such transactions are appropriate. In addition, you may be required to post margin.

Note, this post was written by me & the material is my own, except where sourced. I am not receiving compensation for it.